OVERVIEW

Stellar has teamed up with Life Tenancy Investments to present an opportunity to invest in a unique sector of the UK residential property market.

Stellar Residential Reversion LP (the Fund) will acquire and assemble a portfolio of residential properties that are subject to lifetime lease purchases (LTPs) and will seek to benefit from the significant acquisition discounts and residential house price inflation over time.

The life tenancy sector provides a secure investment into UK residential property with minimal acquisition costs. The medium-term nature of this property asset class means that it can ride market fluctuations and the exit can be engineered to coincide with the correct timing in the property cycles.

The properties will be occupied by life tenants who have purchased the right to live in their chosen property until their lifetime lease terminates. The Fund is expected to contain a mix of life tenants with an average age of 70 and who are expected to occupy the property for an average of 15 years.

The average acquisition discount is expected to be circa 48% below a RICS vacant possession value.

THE PORTFOLIO

The Fund will source appropriate LTP investments across the South of England, where historic and future projected growth continues to be underpinned by a shortage in supply of residential property at the lower end of the market.

Properties will be purchased with a full repairing and insuring residential lease already in place and will be acquired subject to an independent RICS homebuyers report and valuation.

The Manager believes that the Fund’s acquisition strategy will also create a premium increase in the core value of the portfolio. Larger portfolios produce greater certainty of future cashflows from reversions and can therefore demand a premium in the market on a portfolio sale.

Please ask for a list of target properties for the portfolio.

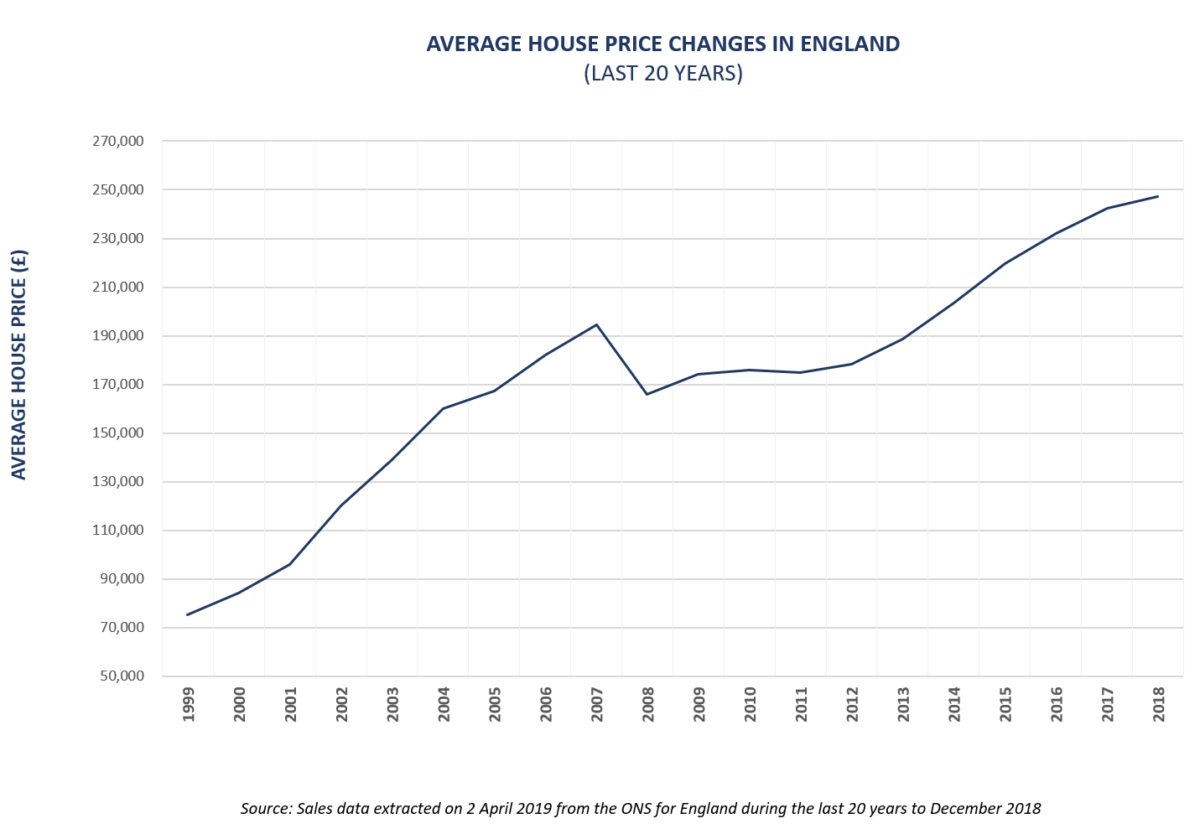

HOUSE PRICES

The Fund’s return will be directly linked to the house price growth in the regions in which it invests over the investment term. During the last 20 years to December 2018, the average property price in England rose by 276%, which equates to an effective compound growth of approximately 7% per annum.

RETURNS

As the portfolio grows and ages with time, the probability of the properties reverting increases. Upon reversion, each property will be sold on the open market to create liquidity for the Fund and any surplus funds will be reinvested into new LTP acquisitions.

The Fund will acquire LTPs that seek to deliver a minimum 4% IRR, based on the actuarily approved life expectancy of tenants living in each property. The running costs and management fees of the Fund will reduce this IRR by approximately 1% to provide the Fund a base return of more than 3% per annum without house price growth.

The Manager will seek to introduce leverage to enhance investor returns by increasing the number of properties that the Fund can acquire.

The graph above illustrates the effect of leverage and house price inflation on IRRs. For example:

If house prices were to continue to rise at approximately 7% per annum, an unleveraged fund could potentially deliver an 11% IRR to investors and a leveraged fund could potentially almost double this to a 21% IRR to investors.

If house prices continue to rise at only 50% of past performance, an unleveraged fund could potentially deliver a 7.5% IRR to investors and a leveraged fund could increase this to a 12% IRR to investors.

LIQUIDITY

The Manager intends to offer investors new subscriptions for the Fund every six months and its medium to long term strategy will be to both supplement investors’ equity with institutional finance to improve returns but also to grow the Fund so that it can be listed on a recognised stock exchange.

Subscriptions and redemptions will be managed on each subscription date.

The exit strategy will be achieved through a public listing, a securitisation or a private sale after five years to investors that are looking for longer term IRRs over a natural reversion timeline.

KEY FACTS

| Launch | 2 April 2019 |

| First Closing Date | 30 June 2019 |

| Minimum investment | £100,000 |

| First capital raise | £2,000,000 |

| Fund size | £25,000,000 |

| Minimum fund size | £2,000,000 |

| Initial fee | 2.5% |

| Management fee | 1% per annum |

FURTHER INFORMATION

For more information, please contact Mark Lenherr at +44 (0)7769 700 027.

Download a printable version of this Overview

Mark Lenherr

Life Tenancy Investments Limited