Key features of the Stellar Bespoke HT Service

Tax efficiency

Relief from IHT, and other tax planning opportunities.

Diversified

This is key to our investment approach and intrinsic to our service.

Control

You invest in your company, so you keep control.

Uncapped returns

Offers uncapped returns from qualifying business activities.

Family Investments

Investments made in your family’s names, to match your family’s bespoke needs.

Investment planning

Opportunities to blend investment sectors to meet your objectives.

The Stellar Bespoke Inheritance Tax Service is designed for sophisticated investors who prefer a tailored discretionary investment approach to improve tax-efficiency. The service offers both flexibility and complete control of your estate and succession plan. Both the investment strategy and selection can be tailored to suit your requirements.

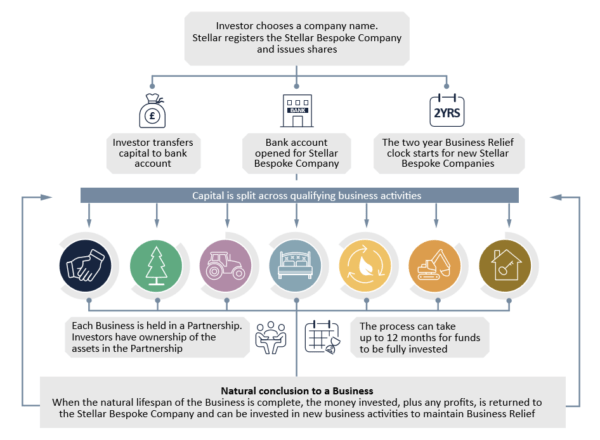

The Stellar Bespoke IHT Service provides you with access to a range of qualifying business activities, which seek to qualify for tax benefits including Business Relief, which offers 100% relief from inheritance tax. The service employs a family trading company structure providing family members the flexibility to allocate assets and capital as required, including multiple companies and multiple share classes.

Investing in Inheritance Tax Services carries risks and is not suitable for everyone,

click here for more information on the Risks of Investing.

Key documents

Target Return

We aim to generate a target return of between 3% to 5% per annum for your Stellar Bespoke Company from our range of qualifying business activities. You are able to select which of these activities you wish your Stellar Bespoke Company to participate in.

This choice will affect your target return. Please note that this is a target only and is not guaranteed.

Intergenerational Planning

The Stellar Bespoke IHT Service allows you to pass family wealth to your beneficiaries without ceding control during your lifetime. Once inherited, your beneficiaries may wish to consider how they can best manage their affairs tax efficiently, and this could well include their estate planning needs.

Families are deliberately establishing estate planning strategies that can be maintained by successive generations, without the need for complex trusts, to provide the next generation with a legacy free from IHT whilst maintaining full control of their capital.

Access to Capital

One of the distinguishing features of the Stellar Bespoke IHT Service is that, unlike some inheritance tax planning, you retain ownership and control of, and access to, your capital.

At some point in the future you may wish to access your capital, and likewise – whilst your beneficiaries may maintain your Stellar Bespoke Company for future generations – they may also wish to access some or all of the capital. It is therefore important that you understand how capital can be accessed, and the timeframes which may be applicable.

Your funds are invested in a Stellar Bespoke Company that is owned by you, and this permits greater control over what it does. Your Stellar Bespoke Company invests in Businesses, to enable it to undertake qualifying activities that enable you to benefit from Business Relief after two years.

Create your preferred portfolio

Investment sector expertise that Stellar can provide includes:

- Arable Farming

An opportunity to benefit from both capital growth and Agricultural Property Relief. - Bridging Finance

Providing a regular source of income with strong levels of asset security. - Commercial Forestry

Offering stable and predictable returns – with all timber sales free from capital gains and income tax. - Commercial Property Development

Acquiring opportunities to develop land for commercial use – underpinned by a freehold or long leasehold interest.

- Hotels

Owning and operating hotels across the UK, to deliver a regular source of annual income and capital growth. - Renewable Energy

Supplying a stable and predictable income – underpinned by the subsidies provided by the Government. - Residential Property Development

Sourcing opportunities to develop land for residential use – underpinned by a freehold or long leasehold interest.

How your Stellar Bespoke Company Works

Choose Your Strategy

There are three main strategies that you can choose from:

The Discretionary Strategy

You choose the investment sectors and we select the underlying investments. This strategy is designed for investors who want to leave a legacy without committing time to sourcing their own investments.

The Tailored Strategy

You choose the assets to invest in. Designed for investors who want complete control of their portfolio.

The Hybrid Strategy

A blend of both the discretionary and tailored strategies. Designed for investors who are happy for Stellar to choose some investments but also want to add their own choices.

You have the option to further adapt your strategy if your circumstances change in the future.

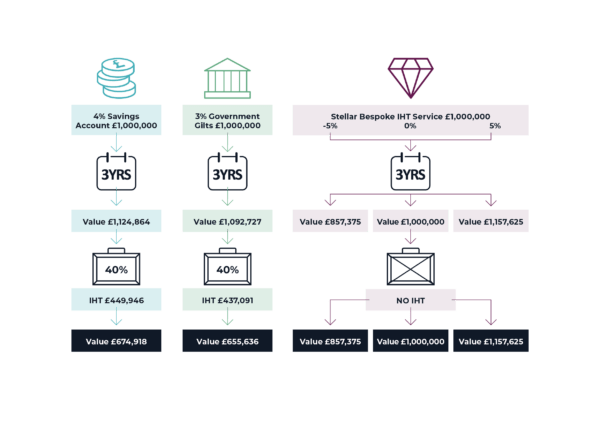

Performance Comparison

The Stellar Bespoke Inheritance Tax Service is carefully designed to provide real returns during your lifetime, as well as a tax-efficient legacy for your beneficiaries. This graphic compares the three year projected performance of a savings account and government gilts with the Stellar Bespoke Inheritance Tax Service.

Please note:

- The Service is higher risk than savings accounts and Government Gilts

- After two years, a holding in the Service should attract 100% relief from IHT, provided the investment is held at the point of death.

- All returns are calculated using compounding of nominal returns and rounded to the nearest whole pound where applicable.

Important Information

Risks

- Your capital is at risk

The value of your Stellar Bespoke Company, and any income derived from it, may go down as well as up and you may not get back the full amount you invested. - Qualifying business activities are not guaranteed

There is no guarantee that sufficient investments in qualifying business activities will be made within the expected timetable, or at all. In addition, qualifying business activities may subsequently cease to qualify for Business Relief. In such cases, Business Relief could be lost or delayed. - Target returns are not guaranteed and you cannot rely on past performance

Please remember that past performance is not a reliable indicator to future performance, and there is no guarantee the target return objectives will be met. - Tax reliefs are not guaranteed

The rates of tax, tax benefits and tax allowances described in this brochure are based on current legislation and HMRC practice. They are not guaranteed, are subject to change, and depend on personal circumstances. In addition, any changes to what constitutes a qualifying business activity may have a material adverse effect on the value of the Businesses or the ability of Stellar to achieve the objectives of the Stellar Bespoke Inheritance Tax Service. - Investments are long-term and high risk

Investments must be held for at least two years, and held at death, to benefit from Business Relief. Although you can request a withdrawal from your Stellar Bespoke Company, there may be a delay because the interests in the Businesses are not liquid. Exits are reviewed quarterly and there is no guarantee that an exit will be possible. Such interests are also considered to be higher risk than securities listed on the London Stock Exchange. - Conflicts of interest

Instances may arise where the interests of one group of investors will present a conflict with the interests of another group, or an interest of Stellar. In the event of a conflict, Stellar’s investment committee will work to ensure that this is resolved fairly and in accordance with its conflict policy.

Fees and Charges

| Initial Subscription Fee | 1.5% |

| Consultancy Fee | Up to 2% of the amount invested |

| Dealing Fee | 1.5% |

| Management Fee | 1% plus VAT |

| Administration Fee | 0.5% plus VAT |

| Performance Fee | 20% of excess above target return |

| Exit Fee (where applicable) | 2% plus VAT |

Stellar AiM IHT Service

A discretionary managed portfolio that mitigates risk through a diversified selection of 40 AiM stocks. This service is available for advised clients, on many of the UK’s largest wrap platforms.

Stellar Business IHT Service

A discretionary managed service which provides numerous succession planning and tax efficiency options for business owners – either following the sale of a company, or to invest excess company capital to maintain tax efficiency.

Stellar Growth IHT Service

This discretionary managed service involves the creation of a privately owned limited company for each investor, to access a portfolio of asset-backed Investment Sectors – targeting 5% growth per annum.