Consolidating Portfolios on a Platform

How Mr and Mrs Jones consolidated their investments from various providers on a wrap platform.

The Client

Mr and Mrs Jones have invested in equities for most of their working lives. They are now in their seventies and were concerned to learn that none of these investments qualify for inheritance tax (IHT) relief. Their portfolio has grown over the years and they are worried by the large IHT bill their children will face when they die. They are also frustrated by the different fees and charges and the inconsistency of reporting on their investments. Some of their investments are already held on a wrap platform and they are looking to move the others on platform to organise their portfolios.

Our Solution

Mr and Mrs Jones spoke to their financial adviser and she suggested that given that they already hold investments on the Transact platform, they move their other investments on to this platform. Because of their large IHT liability, their adviser also suggested investing in the Stellar AiM IHT Service because this should provide full relief from IHT after just two years. Mr and Mrs Jones made a transfer to the Stellar AiM IHT Service. This solution also enables them to retain access to, and control of, their capital.

Key Features

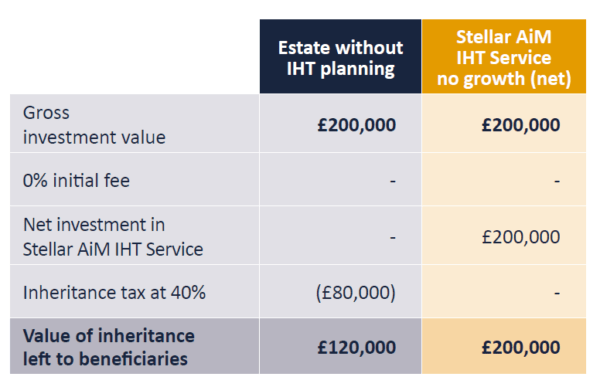

The table below illustrates that even assuming the net value of Mr and Mrs Jones’ Stellar AiM IHT Service portfolio does not increase, their beneficiaries should still save £80,000 after all fees are paid, by not having to pay the 40% IHT liability.

Additionally, Mr and Mrs Jones will benefit from streamlined reporting and their beneficiaries will inherit one consolidated portfolio.

Result after 3 years

Important Information

Risk warning: Your capital is at risk. Investments can fall as well as rise and investors may not get back the full amount invested. Investments in unquoted companies are less liquid and are higher risk than larger companies. The rates of tax, tax benefits and tax allowances described are based on current legislation and HMRC practice. They are not guaranteed, are subject to change and depend on personal circumstances. Please refer to the latest product literature before investing: your attention is drawn to the risks and fees contained therein.

This document dated 7th December 2022 is intended for retail investors and their advisers and has been approved and issued as a financial promotion under the Financial Services and Markets Act 2000 by Stellar Asset Management Limited (‘Stellar’). This document is for information only and does not form part of a direct offer or invitation to purchase, subscribe for or dispose of securities and no reliance should be placed on it. Stellar does not offer investment or tax advice or make recommendations regarding investments. Stellar is authorised and regulated by the Financial Conduct Authority (Firm reference No. 474710). Registered in England No. 06381679. Registered office: 20 Chapel Street, Liverpool L3 9AG.