Benefits of Qualifying Business Activities

Asset-backed

Control

Diversification

Growth

IHT relief

Lasting legacy

Our Investment Sector Expertise

We choose to invest in a diverse range of qualifying business activities, all of which are underpinned by physical assets.

All of the trading activities offered through our Stellar Inheritance Tax solutions are carefully selected, to ensure that they:

- Qualify for Business Relief, and therefore full inheritance tax relief, after two years.

- Are asset-backed to offer a high level of security.

- Are uncorrelated to equities, gilts and bonds to provide investment diversification.

- Can provide a return, after fees, of up to 5% per annum over the medium term.

Capital preservation is the focal point of our Inheritance Tax investments, because we believe this helps to reduce risk.

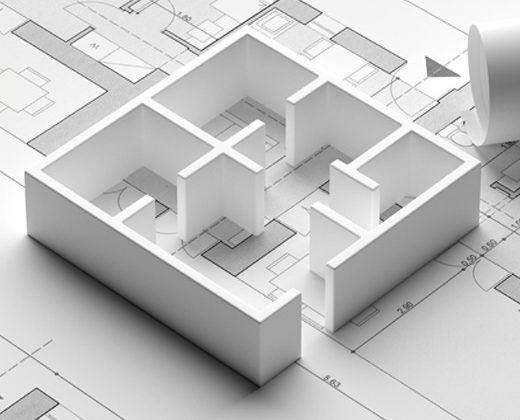

These qualifying business activities are secure, because investors own both the land and either the crops growing on it, or the bricks and mortar. Where capital is used for short term lending purposes, such as bridging finance or development finance, it is secured against assets.

Stellar employs specialist asset managers with extensive expertise in each of these sectors – and this careful and efficient management means that we seek to deliver our target returns, to maximise investment potential.

We continually source and develop new sectors, so that investors benefit from diversification in areas that provide a high level of security. In addition, we do not place caps on performance, so the interests of investors are fully aligned with those of our asset managers.

Investing in Inheritance Tax Services carries risks and is not suitable for everyone,

click here for more information on the Risks of Investing.

Our Business Activities

Commercial Forestry

Offering stable and predictable returns – with all timber sales free from capital gains and income tax.

Commercial Property Development

Acquiring opportunities to develop land for commercial use – underpinned by a freehold or long leasehold.

Hotels

Owning and operating hotels across the UK, to deliver a regular source of annual income and capital growth.

Read more about our range of Inheritance Tax Services

Stellar Bespoke IHT Service

Designed for sophisticated investors who prefer a tailored discretionary investment approach to improve tax-efficiency.

Stellar Business IHT Service

A discretionary managed service which provides numerous succession planning and tax efficiency options for business owners – either following the sale of a company, or to invest excess company capital to maintain tax efficiency.

Stellar Growth IHT Service

This discretionary managed service involves the creation of a privately owned limited company for each investor, to access a portfolio of asset-backed Investment Sectors – targeting 5% growth per annum.